Hanging man candlestick pattern

This section will explore the Hanging Man candlestick pattern, a popular technical analysis tool used by traders to identify potential trend reversals. A hanging man is a bearish reversal pattern

Understanding the Basics Of Hanging man candlestick Pattern

What is a Hanging Man Candlestick Pattern?

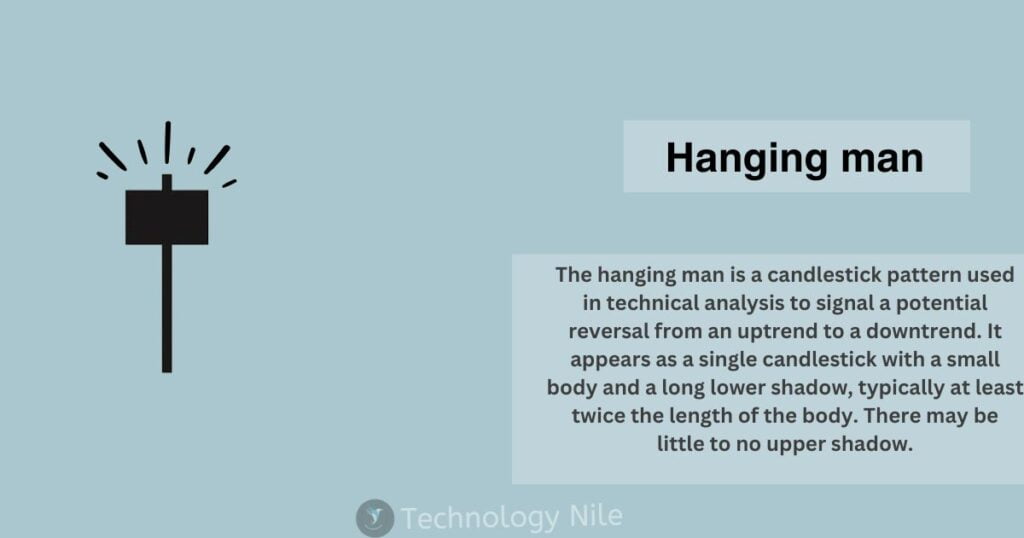

The Hanging Man is a bearish reversal candlestick pattern that forms during an uptrend. It resembles a man hanging from a rope, with a small real body on top and a long lower shadow extending well below the body. This visual resemblance is why the pattern is called the Hanging Man.

Key Characteristics of a Hanging Man

- Small Real Body: The body of the candlestick represents the difference between the opening and closing price. In a hanging man, this real body should be small, indicating little price movement between the open and close.

- Long Lower Wick (Shadow): The key feature is a long lower shadow extending at least twice the length of the real body. This shadow represents a significant drop in price during the trading period.

- Little or No Upper Shadow: There should be minimal or no upper shadow. The upper shadow reflects the day’s highest price, and a small one suggests limited buying pressure.

⚡Note it’s important to remember that technical analysis has limitations, and the market is unpredictable. So, it’s wise to use the hanging man in conjunction with other patterns , strategies or indicators like support and resistance set stop-loss to limit potential losses if the price goes against your prediction For risk management.

Where Does the Hanging Man Appear?

The Hanging Man forms at the end of an uptrend, signaling a potential reversal towards a downtrend. It suggests that even though the price opened higher, sellers emerged and drove the price down considerably before a close near the opening price. This price action indicates hesitation among buyers and a possible gain in strength by sellers.

Limitations of the Hanging Man Pattern

- The hanging man is best suited for short-term trading and may not be reliable for predicting long-term trends.

- Relying on confirmation candles for hanging man patterns (and many others) might lead to missed entry points as prices can move quickly, reducing potential profits.

Conclusion: Is the Hanging Man a Reliable Pattern?

“The Hanging Man candlestick pattern is a valuable tool for identifying potential reversals of an uptrend ” particularly when it appears at the end of a strong uptrend. However, it’s crucial to remember that it’s just one pattern among many in the realm of technical analysis.Traders should not rely solely on the Hanging Man pattern to make trading decisions. Instead, they should combine it with other technical Analysis tools, confirmation strategies, and fundamental analysis to develop a more comprehensive and reliable trading approach.

FAQ?

Q: What does a Hanging Man look like?

Ans. The Hanging Man has a small real body, either hollow (white/green) or filled (black/red), and a long lower shadow that’s at least twice the length of the real body. There’s little to no upper shadow.

Q: Where does the Hanging Man appear?

Ans. This pattern ideally appears at the peak of an uptrend, suggesting the bulls are losing control.

Q: Is the Hanging Man a reliable indicator?

Ans. The Hanging Man is a suggestive pattern, not a guaranteed reversal sign. It’s best used in combine it with other technical Analysis tools like Support and resistance used in technical Analysis and confirmation from subsequent candles.