Waaree Energies IPO Review: A Detailed Analysis

Waaree Energies Limited, India’s largest solar module manufacturer, has entered the Indian stock market with its ₹4,321.44 crore IPO. This article provides a comprehensive review of Waaree Energies’ IPO, covering:

- Oerview and business model

- Financial performance and growth prospects

- Risks and challenges, Future outlook

- Industry Outlook

- Waaree Energies IPO Day-wise GMP

Read the full review now and discover if Waaree Energies’ IPO is the right investment for you

About – Waaree Energies

Overview

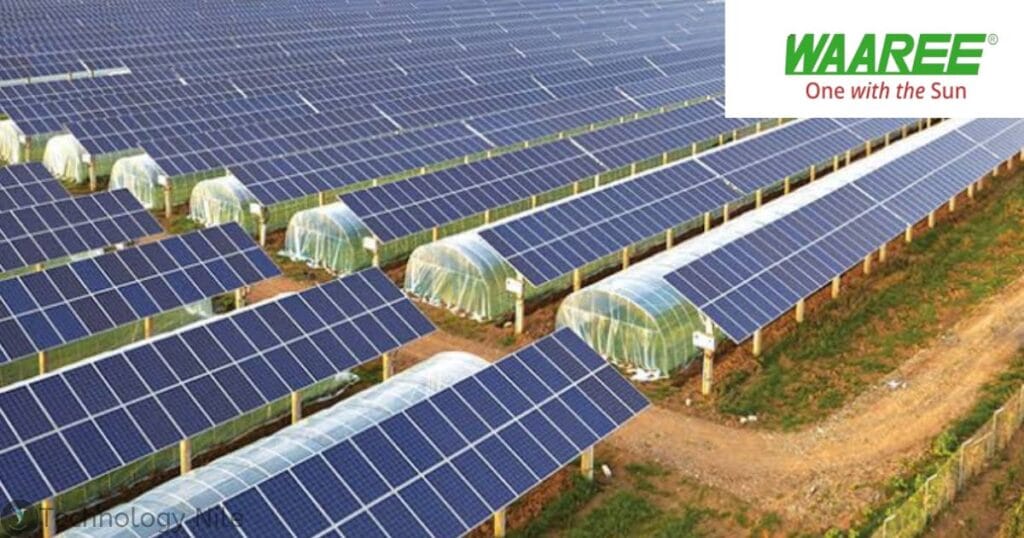

Waaree Energies Limited, founded in 1990, is India’s largest solar module manufacturer with a capacity of 12 GW. Headquartered in Mumbai, India, the company has five solar module manufacturing facilities in India and an international presence.

Waaree Energies commenced operations in 2007, focusing on solar PV module manufacturing. The company aims to provide quality, cost-effective sustainable energy solutions across markets, reducing carbon footprints and improving quality of life. Waaree Energies offers a range of solar solutions, including modules, inverters, batteries, and solar rooftops.

Waaree Energies has manufacturing facilities in Chikhli, Surat, Tumb and Nandigram in Gujarat, with a presence in over 380 locations across India and exports to over 20 countries worldwide. The company is establishing a 3 GW manufacturing facility in the United States.

Waaree Energies expects rooftop solar revenue to surge by 30% or more over the next five years. To drive this growth the company is investing in a fully integrated facility for ingots, wafers, solar cells and solar PV modules, while also expanding its manufacturing capacity with a new 3 GW facility in the United States.

Waaree Energies is India’s largest manufacturer and exporter of solar modules, holding 21% market share. Its installed capacity surged from 2GW in FY21 to 13.3GW by FY24. Market capitalization stands at ₹94,916 crore.

Key Statistics

Waaree Energies faces challenges from Chinese imports, intense competition and reliance on government policies and incentives.

Industry Outlook

India’s solar industry is powering ahead! With a projected growth rate of 9.5% annually from 2024 to 2031, the future looks promising. But what’s driving this growth?

The Indian government is leading the charge with supportive policies and export incentives. Global demand for solar energy is soaring, especially in developing countries. New technologies like HJT and TOPCon are also on the horizon.

India is becoming self-sufficient, reducing its import dependency from 51% to just 6% by 2028. And with a manufacturing capacity of 125 GW by 2029, India will have a surplus of solar modules to export.

- Government support through policies and export incentives

- Soaring global demand, especially in developing countries

- Reduced import dependency (51% to 6% by 2028) in india

- Surplus solar modules for export expected to reach approximately 125 GW capacity by 2029 in india

Strength*

- Market leadership: Waaree Energies dominates India’s solar module manufacturing industry.

- Growth Potential: Renewable energy demand is rising, driven by government initiatives and environmental concerns

- Financial Performance: Impressive revenue growth (99.83% CAGR from 2022 to 2024) and profitability.

- Global Expansion: Establishing a 3 GW manufacturing facility in the US, expanding global presence.

- Long-term Prospects: Increasing focus on solar energy, favorable government policies, and growing demand.

Weakness*

- Dependence on Chinese imports: Waaree Energies imports a significant portion of its materials, especially solar cells, from China, making it vulnerable to geopolitical tensions or trade restrictions.

- Exposure to international market uncertainties: Waaree Energies relies heavily on export sales, particularly to the United States, exposing the company to international market uncertainties.

- Supply chain disruptions: Challenges in maintaining relationships with franchisees, supply chain disruptions, and problems with third-party suppliers could hinder expansion.

- Chinese oversupply of solar components: The oversupply of solar components from China has forced Waaree Energies to lower prices, impacting revenue

- Competition: Intense competition from Chinese imports and other Indian module manufacturers.

- Dependence on Government Policies: Vulnerable to changes in government incentives and regulations.

Waaree Energies IPO Details

Waaree Energies IPO Details:

Waaree Energies IPO open from October 21, 2024 to October 23, 2024, with a price band of ₹1427 to ₹1503 per share. The total issue size was ₹4,321.44 crore, comprising a fresh issue of ₹3,600 crore and an offer for sale of ₹721.44 crore. The company listed on the BSE and NSE on October 28, 2024, with a listing price of ₹2,722.10, which increased to ₹3,346.00 as of November 7, 2024 . This means investors who bought shares during the IPO got a around 22.9% return.

| IPO Date | October 21, 2024 to October 23, 2024 |

| Listing Date | October 28, 2024 |

| Face Value | ₹10 per share |

| Price band | ₹1427 to ₹1503 per share |

| Lot Size | 9 Shares |

| Total issue Size | 28,752,095 shares (aggregating up to ₹4,321.44 Cr) |

| Fresh issue | 23,952,095 shares (aggregating up to ₹3,600.00 Cr) |

| Offer for Sale | 4,800,000 shares of ₹10 (aggregating up to ₹721.44 Cr) |

| Issue type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 263,331,104 |

| Share holding post issue | 287,283,199 |

Waaree Energies IPO Reservation

| Investor Category | Shares offered | Maximum Allottees |

| Anchor Investor Shares Offered | 84,95,887 (29.55%) | NA |

| QIB Shares Offered | 56,63,925 (19.7%) | NA |

| NII (HNI) Shares Offered | 42,47,945 (14.77%) | |

| bNII > ₹10L | 28,31,963 (9.85%) | 20,977 |

| sNII < ₹10L | 14,15,982 (4.92%) | 10,488 |

| Retail Shares Offered | 99,11,869 (34.47%) | 11,01,318 |

| Employee Shares Offered | 4,32,468 (1.5%) | NA |

| Total Shares Offered | 2,87,52,094 (100%) |

Waaree Energies IPO Anchor investors Details

| Bid Date | October 18, 2024 |

| Shares offered | 8,495,887 |

| Anchor Portion Size (In Cr.) | 1,276.93 |

| Anchor lock-in period end date for 50% shares (30 Days) | November 22, 2024 |

| Anchor lock-in period end date for remaining shares (90 Days) | January 21, 2025 |

Waaree Energies IPO Lot Size

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 9 | ₹13,527 |

| Retail (Max) | 14 | 126 | ₹189,378 |

| S-HNI (Min) | 15 | 135 | ₹202,905 |

| S-HNI (Max) | 73 | 657 | ₹987,471 |

| B-HNI (Min) | 74 | 666 | ₹1,000,998 |

Waaree Energies IPO Timeline

| IPO Open Date | Monday, October 21, 2024 |

| IPO Close Date | Wednesday, October 23, 2024 |

| Basis of Allotment | Thursday, October 24, 2024 |

| initiation of refunds | Friday, October 25, 2024 |

| Credit of Shares to Demat | Friday, October 25, 2024 |

| Listing Date | Monday, October 28, 2024 |

| Cut-off time for UPI mandate Confirmation | 5:00 PM on Wednesday, October 23, 2024 |

Waaree Energies Financials

| Particulars | Period ended June 30, 2024 | Period ended March 31, 2024 | Period ended March 31, 2023 | Period ended March 31, 2022 |

| Assets | 11,989.48 | 11,313.73 | 7,419.92 | 2,237.40 |

| Revenue | 3,496.41 | 11,632.76 | 6,860.36 | 2,945.85 |

| Profit After Tax | 401.13 | 1,274.38 | 500.28 | 79.65 |

| Net Worth | 4,471.71 | 4,074.84 | 1,826.02 | 427.13 |

| Reserves and surplus | 4,221.69 | 3,825.00 | 1,594.92 | 230.43 |

| Total Borrowing | 261.24 | 317.32 | 273.48 | 313.08 |

Waaree Energies IPO Promoter Holding

| Share Holding Pre Issue | 71.80% |

| Share Holding Post Issue | 64.30% |

Waaree Energies IPO Listing Details

| Listing Date | October 28, 2024 |

| BSE Script Code | 544277 |

| NSE Symbol | WAAREEENER |

| ISIN | INE377N01017 |

| Final issue Price | ₹1503 per share |

Waaree Energies Listing Day trading information

| Price Details | BSE | NSE |

| Final issue Price | ₹1,503.00 | ₹1,503.00 |

| Open | ₹2,550.00 | ₹2,550.00 |

| Low | ₹2,294.55 | ₹2,300.00 |

| High | ₹2,600.00 | ₹2,624.40 |

| Last Trade | ₹2,336.80 | ₹2,338.90 |

Waaree Energies KPI (Key Performance indicators)

| KPI | Values |

| ROE (%) | 8.79 |

| ROCE (%) | 9.45 |

| Debt/Equity | 0.06 |

| RoNW (%) | 8.81 |

| P/BV | 8.84 |

| PAT Margin (%) | 11.47 |

| Pre IPO | Post IPO | |

| EPS (₹) | 48.69 | 56.16 |

| P/E (x) | 30.87 | 26.76 |

Waaree Energies IPO Subscription Status (Bidding Details)

| Category | Subscription (times) |

| QIB | 215.03 |

| NII | 65.25 |

| bNII (bids above ₹10L) | 71.32 |

| sNII (bids below ₹10L) | 53.10 |

| Retail | 11.27 |

| Employee | 5.45 |

| Total | 79.44 |

Waaree Energies IPO Day-wise Grey Market Premium (GMP)

The Grey Market Premium (GMP) of Waaree Energies’ IPO fluctuated significantly in the days leading up to its listing. Starting from ₹0 on October 14, 2024 the GMP rose to ₹1280 on October 15, 2024 and continued to increase reaching ₹1590 on October 24, 2024, the allotment date. On the listing date October 28, 2024, the GMP stood at ₹1295

| GMP Date | IPO Price | GMP | Sub2 Sauda rate | Estimated Listing Price | Last Updated |

| 28-10-2024 (Listing) | 1503.00 | ₹1295 | 8900/133500 | ₹2798 (86.16%) | 28 October, 2024 |

| 27-10-2024 | 1503.00 | ₹1275 | 8700/130500 | ₹2778 (84.83%) | 27 October, 2024 |

| 26-10-2024 | 1503.00 | ₹1225 | 8400/126000 | ₹2728 (81.5%) | 26 October, 2024 |

| 25-10-2024 | 1503.00 | ₹1320 | 9000/135000 | ₹2823 (87.82%) | 25 October, 2024 |

| 24-10-2024 (Allotment) | 1503.00 | ₹1590 | 10900/163500 | ₹3093 (105.79%) | 24 October, 2024 |

| 23-10-2024 (Close) | 1503.00 | ₹1560 | 10700/160500 | ₹3063 (103.79%) | 23 October, 2024 |

| 22-10-2024 | 1503.00 | ₹1375 | 9400/141000 | ₹2878 (91.48%) | 22 October, 2024 |

| 21-10-2024 (Open) | 1503.00 | ₹1500 | 10300/154500 | ₹3003 (99.8%) | 21 October, 2024 |

| 20-10-2024 | 1503.00 | ₹1510 | 10300/154500 | ₹3013 (100.47%) | 20 October, 2024 |

| 19-10-2024 | 1503.00 | ₹1470 | 10100/151500 | ₹2973 (97.8%) | 19 October, 2024 |

| 18-10-2024 | 1503.00 | ₹1425 | 9700/145500 | ₹2928 (94.81%) | 18 October, 2024 |

| 17-10-2024 | 1503.00 | ₹1330 | 9100/136500 | ₹2833 (88.49%) | 17 October, 2024 |

| 16-10-2024 | 1503.00 | ₹1545 | 10600/159000 | ₹3048 (102.79%) | 16 October, 2024 |

| 15-10-2024 | NA | ₹1280 | ₹1280 (%) | 15 October, 2024 | |

| 14-10-2024 | ₹0 | ₹ (0%) | 14 October, 2024 |

Waaree Energies Stock Buy or Not?

Buy

Waaree Energies strong market position, growth potential and improving debt profile outweigh the risks, making it a compelling investment opportunity for long-term investors

22.9% increase in stock price from October 28 to November 7

60%

Avoid

Unfavorable factors, such as high valuation, intense competition from Chinese imports, dependence on government policies, and raw material volatility, outweigh Waaree Energies growth potential, making it a risky investment

20%

Neutral

Waaree Energies strengths, such as market leadership and growth potential, are balanced by concerns, including high valuation, competition and regulatory risks. Investors should monitor the company’s progress and market trends before making a decision

20%

Conclusion

Waaree Energies IPO offers an attractive opportunity to invest in growing solar module manufacturing industry. With a strong market position, impressive financial performance, and favorable industry trends, the company is well-positioned for growth.

Disclaimer

This article is not written by a financial advisor, and it should not be considered as personalized financial advice. It is essential to consult a financial expert before making any investment decisions or Do your own research before investing.

FAQ?

Q: What is Waaree Energies IPO size?

Ans. Waaree Energies IPO size is ₹4,321.44 crore.

Q: What is Waaree Energies financial performance?

Ans. Waaree Energies has shown impressive revenue growth and profitability in recent years.

Q: What are the key risks associated with Waaree Energies IPO?

Ans. Risks include intense competition, regulatory changes, and dependence on government policies.

Q: What is Waaree Energies industry outlook?

Ans. India’s solar industry is expected to grow at a CAGR of 9.5% from 2024 to 2031

Q: How do I apply for Waaree Energies IPO?

Ans. You can apply through your bank, broker, or online platforms like Zerodha, Upstox, etc.

Q: Is Waaree Energies IPO a good investment opportunity?

Ans. Our review provides a detailed analysis to help you make an informed decision